GRI 2-12, 2-13, 2-14, 2-29, 3-1 and 3-2

STRATEGY

As part of our sustainability efforts, during 2021 we launched a project, hand in hand with a third party, for the development of a well-grounded and robust ESG strategy. This involved the execution of a materiality assessment and identification of stakeholders, as this is the first step in defining strategic priorities and meeting the expectations of the latter.

Additionally, under this strategy, a governance structure will be defined, including both management positions and an operational area, responsible for the implementation of the strategy, as well as the oversight and follow-up of environmental, social and, governance issues to ensure that the sustainability culture permeates throughout the organization, covering the different areas and business units.

Also, following this strategy, we developed specific KPIs for each of our material topics, which involved the estimation of a baseline to establish concrete, clear, feasible, and measurable objectives, together with a roadmap to achieve them.

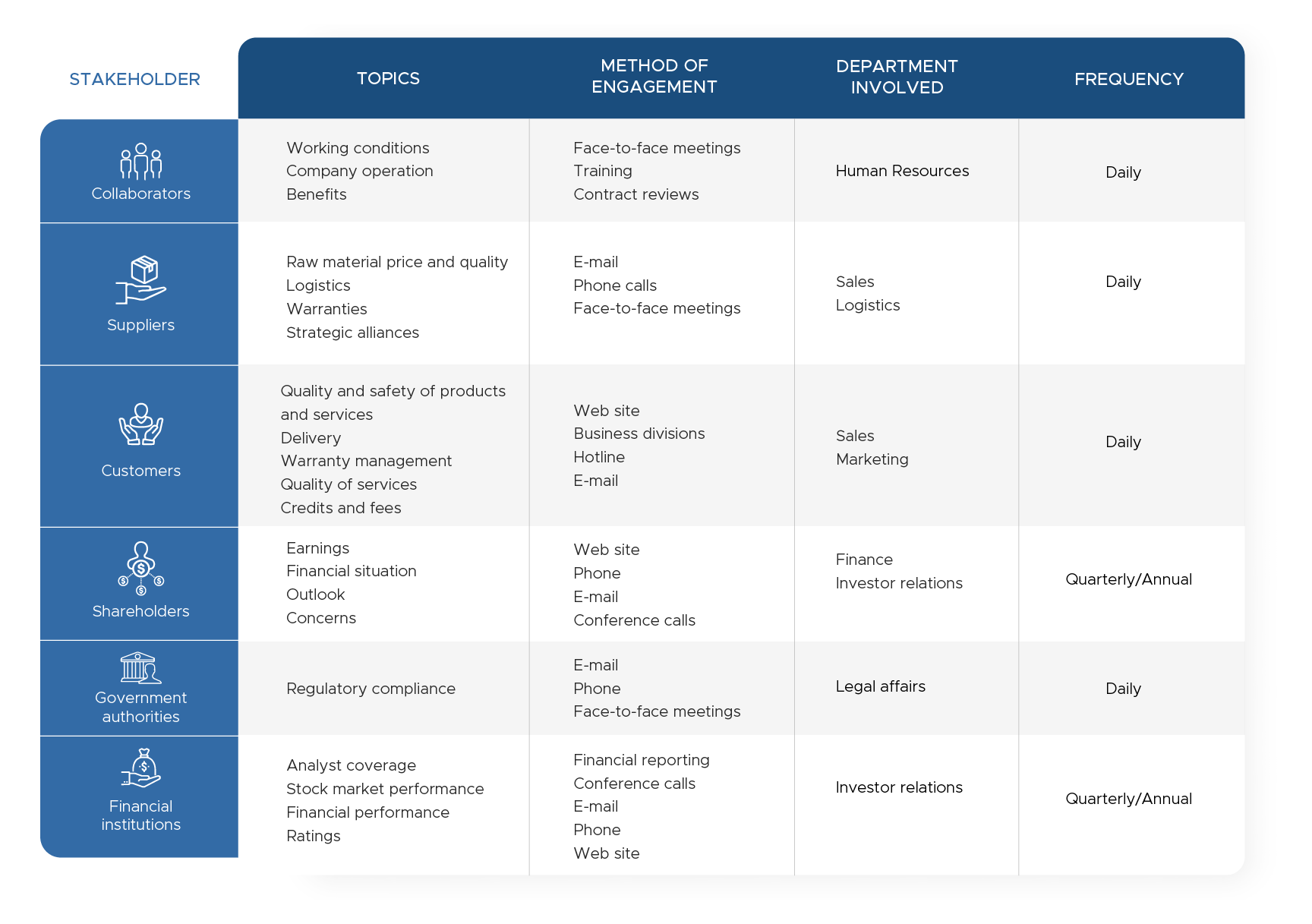

Stakeholders

At Grupo Bafar we identify our stakeholders and define a communication and outreach strategy to meet their needs and expectations, identifying the issues to be addressed, the methods of engagement, and the frequency.

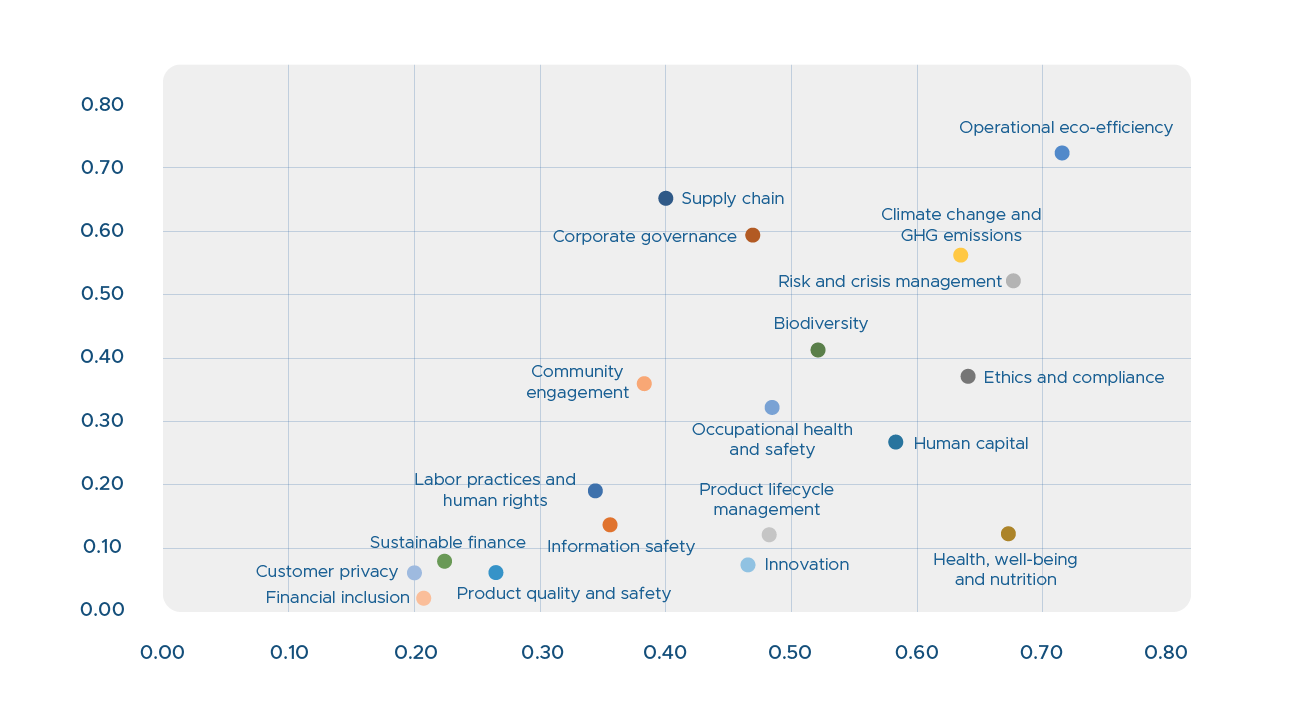

MATERIALITY

At Grupo Bafar we are aware of the importance of identifying the priority issues for the development of an ESG strategy that generates a greater impact both inside and outside the organization and creates long-term value for our stakeholders.

Our materiality exercise conducted in 2021 allows us to increase operational efficiency and focus our efforts and resources on managing the most relevant issues.

Methodology

- Identification of the top 10 material topics for each of the Group’s Business Units

- Analysis of standards requirements and investors to identify the most relevant topics for external stakeholders.

- Analysis and integration of industry and leading companies’ studies

- Strategic surveys to Grupo Bafar’s key corporate staff to identify relevant topics for internal stakeholders

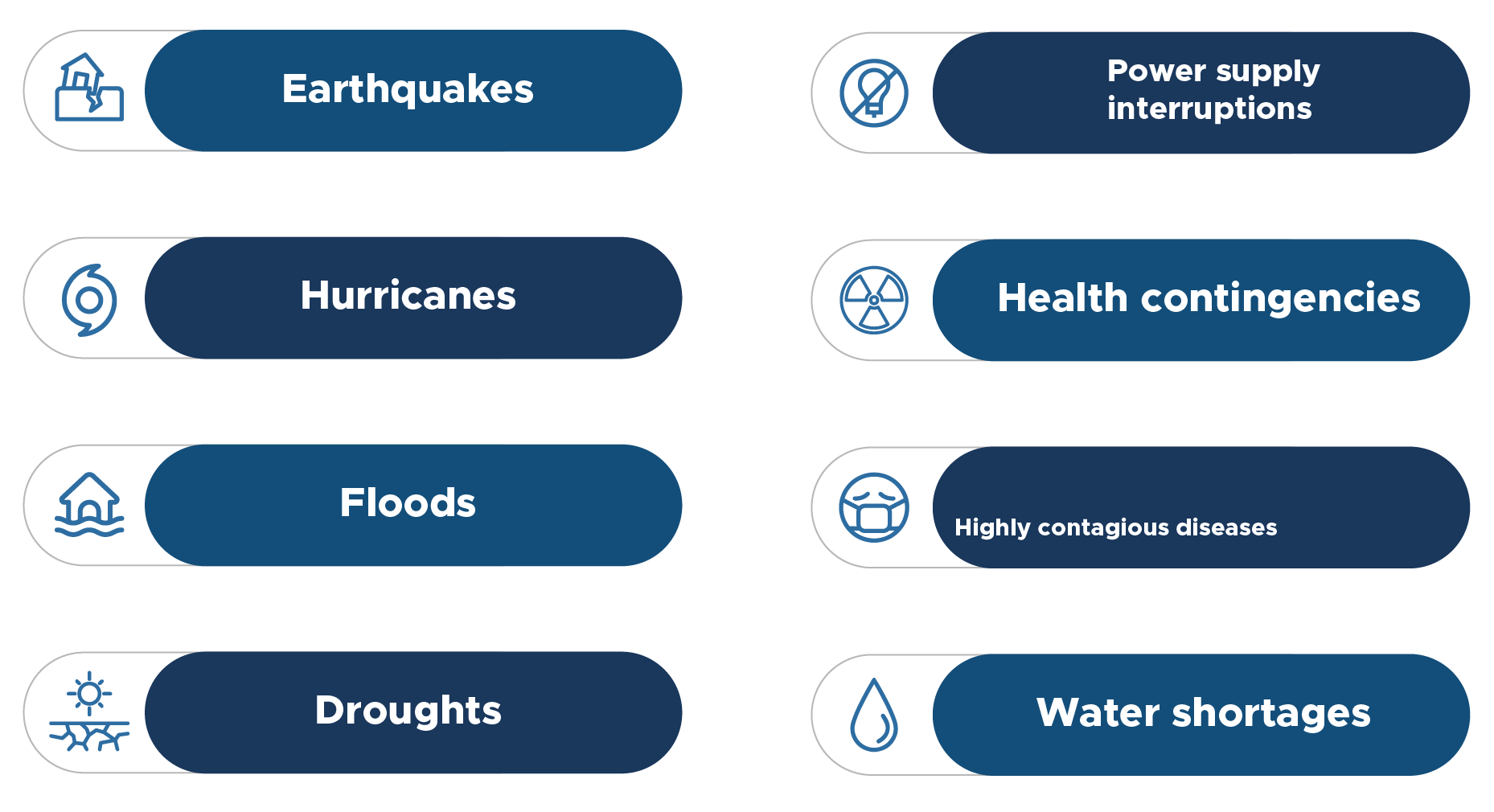

Risk and crisis management

In Grupo Bafar we have identified the environmental, social, and economic risks to which the organization may be exposed due to the nature of our activities.

Our operations are primarily based in Northern Mexico; therefore, we have identified the following risks that could have an impact on the Company’s operational performance and financial situation via effects on product demand, uncertainty in the supply chain, damage to the Company’s facilities, fluctuations in the price of raw materials:

These risks are monitored on a regular basis by the internal control area, which is responsible for mitigating potential risks and developing contingency plans, as needed, to achieve specific business objectives and minimize the negative impacts that may arise from such risks.

Additionally, for the purpose of attaching the necessary attention and importance to ESG issues on an ongoing basis, the economic, environmental, and social risks and opportunities applicable to the organization are monitored and discussed annually at the Shareholders’ Meeting.